SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement | |

☐ | ||

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

☒ | Definitive Proxy Statement | |

☐ | Definitive | |

☐ | ||

Soliciting Material Pursuant to §240.14a-12 | ||

CURTISS-WRIGHT CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| No fee required. | |||||

☐ | ||||||

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||||||

(1) | Title of each class of securities to which transaction applies: | |||||

(2) | Aggregate number of securities to which transaction applies: | |||||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||||

(4) | Proposed maximum aggregate value of transaction: | |||||

(5) | Total fee paid: | |||||

| Fee paid previously with preliminary materials. | |||||

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||

(1) | Amount Previously Paid: | |||||

(2) | ||||||

Form, Schedule or Registration Statement No.: | ||||||

(3) | Filing Party: | |||||

(4) | Date Filed: | |||||

Dear Valued Stockholder:

You are cordially invited to attend the annual meeting of stockholders of Curtiss-Wright Corporation to be held on Thursday, May 10, 2018,2, 2024, at the Homewood Suites by Hilton, 125 Harbour Place Drive, Davidson, North Carolina 28036, commencing at 10:1:00 a.m.p.m. local time.time (the “Annual Meeting”).

We intend to hold the Annual Meeting in person again this year. The proxies that we solicit give you the opportunity to vote on all scheduled matters that come before the annual meeting. Whether or not you plan to attend, you can be sure that your shares are represented by promptly voting and submitting your proxy by phone or by internet as described in the following materials. If you want proxy materials mailed to you, you can make a request by completing, signing, dating and returning your proxy card in the postage-paid envelope provided. Please refer to the accompanying Notice of Annual Meeting and Proxy Statement for further important information about the Annual Meeting.

The Notice of Annual Meeting and the Proxy Statement, which follow this letter, provide information concerning matters to be considered and acted upon at the annual meeting. We will present a brief report on our business followed by a question and answerquestion-and-answer period at the annual meeting.

In accordance with rules adopted by the U.S. Securities and Exchange Commission, we are using the internet as our primary means of furnishing proxy materials to our stockholders. Accordingly, most stockholders will not receive paper copies of our proxy materials. We will instead send our stockholders a notice with instructions for accessing the proxy materials and voting electronically over the internet or by telephone. The notice also provides information on how stockholders may request paper copies of our proxy materials. We believe electronic delivery of our proxy materials will help us reduce the environmental impact and costs of printing and distributing paper copies and improve the speed and efficiency by which our stockholders can access these materials.

We know that manyare resolutely focused on strengthening our culture and our workplace—putting greater emphasis on diversity, talent acquisition and development, and the employee experience. We are committed to ensuring our business practices are sustainable, and we will do our part to support the ongoing environmental, social and governance (ESG) issues, so the state of youour planet and our communities are unablehealthier tomorrow than they are today.

Finally, on behalf of the entire Curtiss-Wright family, I wish to attendthank S. Marce Fuller, who will retire from the Board just prior to our 2024 annual meeting in person. The proxies that we solicit give youof stockholders. Ms. Fuller is retiring with more than 24 years of distinguished service and leadership at Curtiss-Wright, which includes serving as lead independent director for the opportunity to votepast three years. I congratulate Ms. Fuller on all scheduled matters that come before the annual meeting. Whether or not you plan to attend, you can be sure that your shares are represented by promptly votingher retirement and submitting your proxy by phone or by internet as described in the following materials. If you want proxy materials mailed to you, you can make a request by completing, signing, dating,thank her for her leadership, counsel, and returning your proxy card enclosed with those materials in the postage-paid envelope provided to you.friendship.

On behalf of your Board of Directors, management, and our employees, I would like to express our appreciation for your continued support. I look forward to your participation in the Annual Meeting.

Sincerely, | ||

| Lynn M. Bamford

| |

|

CURTISS-WRIGHT CORPORATIONOne

130 Harbour Place Drive, Suite 300, Davidson, North Carolina 28036

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To the holders of the common stock of Curtiss-Wright Corporation:

Notice is hereby given that the annual meeting of stockholders (the “Annual Meeting”) of Curtiss-Wright Corporation, a Delaware corporation (the “Company”), will be held on Thursday, May 10, 2018,2, 2024, at the Homewood Suites by Hilton, 125 Harbour Place Drive, Davidson, North Carolina 28036, commencing at 10:1:00 a.m.pm local time, for the following purposes:

| (1) | To elect the nine director nominees named herein; | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(2) | To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 2024; | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| To approve the Curtiss-Wright Corporation 2024 Omnibus Incentive Plan; | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (4) | To approve on an advisory | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (5) | To consider and transact such other business as may properly come before the Annual Meeting. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Only record holders of the Company’s common stock at the close of business on March 12, 2018,8, 2024, the record date for the Annual Meeting, are entitled to notice of and to vote at the Annual Meeting. A list of stockholders will be available for examination by any stockholder(s) at the Annual Meeting and during normal business hours at the offices of the Company, One130 Harbour Place Drive, Suite 300, Davidson, North Carolina 28036, during the ten days preceding the Annual Meeting date.

The Company cordially invites all stockholders to attend the Annual Meeting in person. Stockholders who plan to attend the Annual Meeting in person are nevertheless requested to vote their shares electronically over the Internet, or by telephone, or if you receive a proxy card in the mail, by mailingsigning, dating and returning the completed proxy card in the postage-paid envelope provided, to make certain that their vote will be represented at the Annual Meeting should they be prevented unexpectedly from attending.

By Order of the Board of Directors, | ||

|  | |

March | Paul J. Ferdenzi | |

| ||

| General Counsel |

IMPORTANT: WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE PROMPTLY SUBMIT YOUR PROXY ELECTRONICALLY OVER THE INTERNET OR BY TELEPHONE, OR IF YOU RECEIVE A PAPER PROXY CARD, PLEASE FILL IN, SIGN AND PROMPTLY RETURN YOUR PROXY CARD IN THE ENCLOSED POSTAGE-PAID ENVELOPE

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be Held on Thursday, May 10, 2018.2, 2024.A Notice and Proxy Statement and combined Business Review/20172023 Annual Report on Form 10-K to security holders are available at: www.proxyvote.com.www.proxyvote.com.

CURTISS-WRIGHT CORPORATIONOne

PROXY SUMMARY

The following is a summary that highlights information contained elsewhere in this Proxy Statement. This summary does not contain all the information you should consider, and before voting, you are urged to carefully read the entire Proxy Statement.

Voting Matters and Vote Recommendations

The Company currently expects to consider four items of business at the 2024 Annual Meeting. The following table lists those items of business and the Board’s vote recommendation.

| Proposal | Board Recommendation | Reasons for Recommendation | More Information |

| (1) Election of the nine director nominees named herein to a one-year term | FOR ALL | The Board and the Committee on Directors and Governance believe the nominees possess the skills, experience, qualifications, and diversity to effectively monitor performance, provide oversight and support management’s execution of the Company’s long-term strategy. | Page 12 |

| (2) Ratification of the independent registered public accounting firm | FOR | Based on their assessment, the Board and the Audit Committee believes that the appointment of Deloitte & Touche LLP is in the best interests of the Company and its stockholders. | Page 79 |

| (3) Approve the Curtiss-Wright Corporation 2024 Omnibus Incentive Plan | FOR | To foster and promote the long-term financial success of the Company and to increase stockholder value by (i) providing eligible employees, officers, non-employee directors, consultants, and advisors of the Company with incentives that align their interests with stockholders’ interests and that contribute to the long-term growth and profitability of the Company, and (ii) enabling the Company to attract, retain and motivate highly qualified employees, officers, non-employee directors, consultants, and advisors who are in a position to make significant contributions to the Company for its successful operations. | Page 81 |

| (4) Advisory vote to approve the compensation of the Company’s named executive officers | FOR | The Company’s executive compensation program incorporates several compensation governance best practices and reflects the Company’s commitment to pay for performance. | Page 90 |

Director Nominees

Set forth below is summary information concerning the Company’s Director Nominees who are being voted on at the Annual Meeting.

| Name | Age | Director Since | Principal Occupation | Independent |

| Lynn M. Bamford | 60 | 2021 | Chair and Chief Executive Officer, Curtiss-Wright Corporation | No |

| Dean M. Flatt | 73 | 2012 | Former President and Chief Operating Officer, Honeywell International’s Defense and Space business | Yes |

| Bruce D. Hoechner | 64 | 2017 | Former President and Chief Executive Officer, Rogers Corporation | Yes |

| Glenda J. Minor | 67 | 2019 | Chief Executive Officer and Principal, Silket Advisory Services | Yes |

| Anthony J. Moraco | 64 | 2021 | Former Chief Executive Officer and member of the Board of Directors, Science Applications International Corporation | Yes |

| Admiral (Ret.) William F. Moran | 65 | 2023 | President, WFM Advisors, LLC; Former Vice Chief of Naval Operations | Yes |

| Robert J. Rivet | 69 | 2011 | Former Executive Vice President, Chief Operations and Administrative Officer, Advanced Micro Devices, Inc. | Yes |

| Peter C. Wallace | 69 | 2016 | Former Chief Executive Officer, Gardner Denver Inc. | Yes |

| Lieutenant General (Ret.) Larry D. Wyche | 66 | 2023 | Chief Executive Officer, Wyche Leadership and Federal Contracting Consulting; Former Deputy Commanding General, U.S. Army Materiel Command | Yes |

| 2 |

Corporate Governance Highlights

The Company is committed to good corporate governance, which promotes the long-term interests of stockholders, strengthens Board and executive leadership accountability, and helps build public trust in the Company. As part of this commitment, the Board has adopted best practices in corporate governance, including the following:

| Board Independence | Lead Independent Director |

• 8 out of 9 director nominees are independent • 100% independent Board committees • Chair and CEO is the only management Director nominee | • Consults with Chair regarding setting Board meeting agendas, and consults with all Board committees • Serves as liaison between the Chair and the independent directors • Facilitates communication between and among the independent directors and management • Presides at all Board meetings where the Chair is not present, including executive sessions of the independent directors • Is available, when appropriate, for consultation and direct communication with stockholders • Coordinates annual Board performance review of Chief Executive Officer • Leads the discussion of Board’s self-assessment and evaluation of results |

| Board Practices | Other Best Practices |

• Annual election of directors • Annual Board and committee evaluations • Regular executive sessions of non-management directors • Board participation in executive succession planning • Annual review of Committee Charters and Corporate Governance Principles • Robust risk oversight with Board and committee roles | • Comprehensive Code of Conduct and Corporate Governance Principles • Anti-hedging and pledging policy • Annual Say-on-Pay Vote • Robust “clawback” policies for Incentive Compensation, including the adoption of an incentive compensation clawback policy for Section 16 officers pursuant to Dodd-Frank in the event of certain accounting restatements • Robust stock ownership requirements for directors and executive officers • Strong pay-for-performance philosophy • Succession Planning Process |

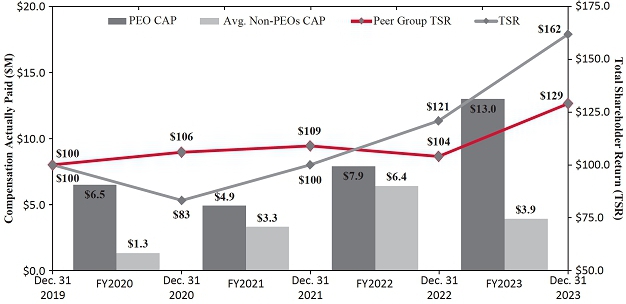

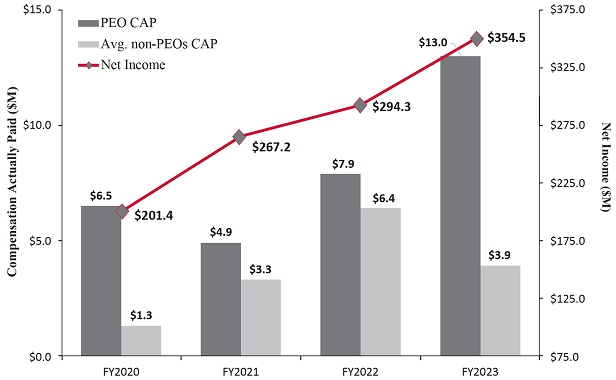

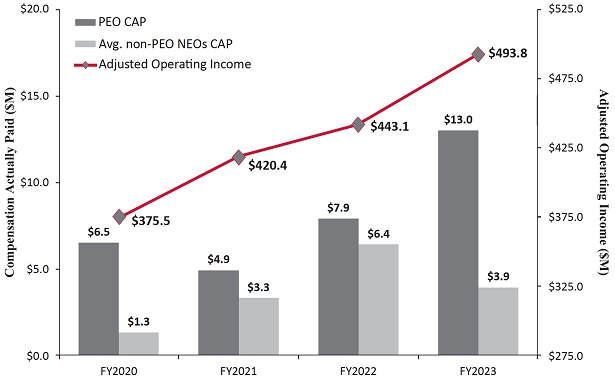

2023 Financial Performance Highlights

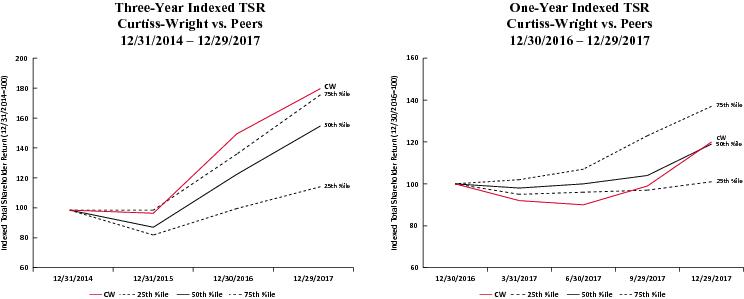

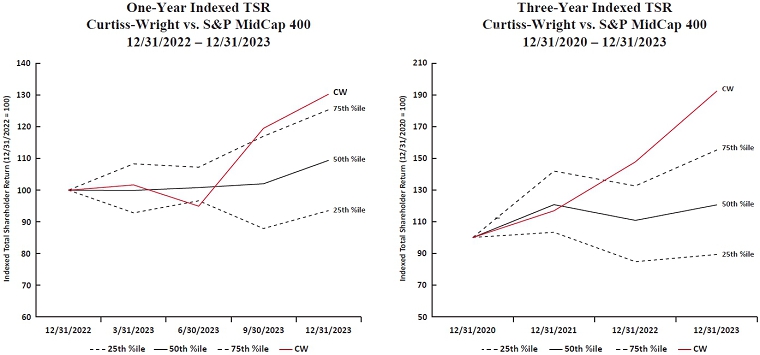

Despite the challenges relating primarily to continuing supply chain delivery disruptions, workforce availability issues, and inflationary pressures, the Company performed very well in fiscal 2023, with strong increases in sales, operating income, earnings per share, and free cash flow. In 2023, the Company’s three-year total shareholder return (TSR) ranked in the 87th percentile against the S&P MidCap 400. TSR is the change in the Company’s Common Stock share price plus dividends from the beginning of the measurement period to the end (three years, 1/1/2021 to 12/31/2023). The Company’s 2023 financial performance as measured under the Company’s executive compensation plans were as follows:

| • | Adjusted organic Sales Growth of 10.7%. | |

| • | Adjusted operating income of $494 million. | |

| • | Working capital as a percentage of sales of 23.8%. |

| 3 |

The Company’s financial performance includes adjustments referenced in the Company’s fourth quarter 2023 earnings release furnished to the SEC on February 15, 2024. The Company’s financial performance above excludes the performance of any acquisitions consummated during the performance period.

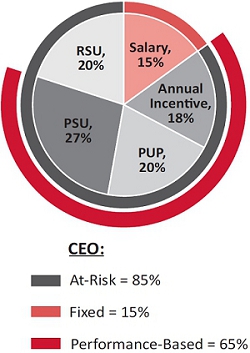

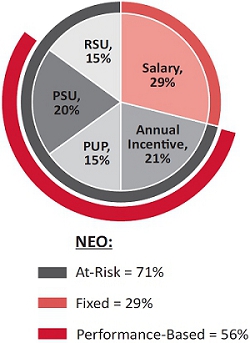

Executive Compensation Practices Highlights

The Executive Compensation Committee is firmly committed to implementing a compensation program that aligns management and stockholder interests, encourages executives to drive sustainable stockholder value creation, and helps retain key personnel. In 2023, the Company received 92% stockholder support for the Company’s “Say-on-Pay” vote, which the Executive Compensation Committee considers to be among the most important items of feedback about the Company’s executive compensation program. The Company recognizes and rewards its executive officers through compensation arrangements that directly link their pay to the Company’s performance, and the Company ensures a strong alignment of interests with its stockholders by including a significant amount of performance-based compensation in the overall mix of pay. The Company’s pay mix includes base salary, an annual incentive cash bonus plan, and a long-term incentive plan under which the Company grants time-based restricted stock units and performance-based cash and stock units. Key elements of the Company’s pay practices are as follows:

| What Curtiss-Wright Does | What Curtiss-Wright Does Not Do |

| • Aligns pay and performance using measures of financial and operating performance including use of relative TSR | • No NEO employment agreements • Does not engage in executive compensation practices that encourage excessive risk |

| • Balances short-term and long-term incentives using multiple performance measures that focus on profitable top line growth | • No short sales, hedging, or pledging of Curtiss-Wright stock permitted • No reloading, re-pricing or backdating stock options |

| • Places maximum caps on incentive payout consistent with market competitive practice | • No tax gross-ups on change-in-control benefits for executives |

| • Establishes rigorous stock ownerships guidelines for NEOs and Board members including a 50% mandatory hold on net shares until ownership guidelines are met for NEOs | • No dividends on unvested or unearned performance units/shares • No excessive perquisites |

| • Maintains robust “clawback” policies for Incentive Compensation, including the adoption of an incentive compensation clawback policy for Section 16 officers pursuant to Dodd-Frank in the event of certain accounting restatements | • No excessive severance and/or change-in-control provisions |

| • Uses an independent external compensation consultant to review and advise on executive compensation | |

| • Uses double trigger Change-in-Control Agreements for equity vesting under the Company’s Long Term Incentive Plan |

| 4 |

Corporate Sustainability

The Company’s business and operations aligns with the Aerospace and Defense Global Industry Classification Standard. The Company believes that a commitment to positive environmental, social and governance-related business practices strengthens its operations, increases the Company’s connection with all stakeholders, and helps the Company better serve its customers and the communities in which the Company operates. The Company’s commitment to social responsibility extends to the environment, ethical business practices, trade compliance, responsible sourcing, human rights, cybersecurity, data privacy, human capital management, labor practices and our employees’ health and safety. More information is available within the Sustainability section of the Company’s website at www.curtisswright.com/company/sustainability/. The Company also sees in these commitments additional ways of creating value for the Company’s stockholders, current and prospective employees, customers and other stakeholders. The Company demonstrates its commitments through its corporate social responsibility program (“CSR”). The CSR program outlines the Company’s commitments, guidelines, and policies, which governs the Company’s behavior and its business practices. To better manage the CSR program, the Company created a cross-functional ESG Council led by the Company’s General Cousel, which meets on a regular basis, and is responsible for establishing and promoting the strategies, standards and practices that advance the Company’s CSR performance.

The CSR program consists of three inter-related activity areas that are mutually supportive of each other:

| Business Practice | We conduct business in an environmentally conscious, socially responsible and ethical manner, including efforts to mitigate climate change and promote sustainability, while protecting the health and safety of the Company’s workers and community. • We comply with all applicable environmental, health and safety (EHS) laws and regulations as stated in our Environmental, Health and Safety Values statement available on the Company’s website. • We track total recordable rate (TRR) and days away, restriction and transfer rate (DART) for all sites worldwide. Our TRR and DART rates for 2023 were 1.32 and 0.86, respectively. • We encourage environmental and safety certifications for our manufacturing facilities. There are 13 sites across the Company that maintain certifications to either ISO 14001 and/or OHSAS 18001/ISO 45001. • We conduct third-party EHS audits to verify that we are meeting our regulatory compliance requirements worldwide. • We are focused on promoting environmental stewardship and introducing innovative processes and technologies that improve our efforts, including quantifying our environmental impact along with our efforts to maximize future generations’ ability to live, work, and play in our shared natural environment. In early 2021, we started to compile utility data (including energy and water consumption) across all global operations to establish a three-year energy baseline. In 2023, we transitioned utility bill management to a third party to determine greenhouse gas (GHG) emissions in accordance with industry standards and applicable regulatory reporting requirements. We disclosed the findings of this initial climate data in early 2024 within the “Sustainability” section of the Company’s website. • As an environmentally conscious company, we focus on and support efforts that move towards a zero-waste future by conserving energy and water, minimizing waste and emissions, and promoting recycling and renewable energy to reduce adverse environmental impacts. • In 2021, we launched a company-wide EHS Management System (EHS MS) that details required practices to maintain a proactive risk-based approach to identify and control risks, comply with regulatory requirements, and continuously improve performance. The EHS MS is being implemented in a phased approach and progress is measured and reported to senior leadership via leading indicators. The EHS MS was designed to be consistent with ISO 14001 requirements. • We utilize safe technologies, training programs, effective risk management practices, and sound science in our operations to minimize risk to employees. |

| 5 |

| Business Practice | We believe a diverse workforce creates a richer culture, enhances performance, and attracts the best talent. • We build a culture of inclusion with a focus on leadership, eliminating systemic barriers and fostering engagement. We conduct employee engagement pulse surveys to our global workforce concerning our work environments. • We utilize exit interviews and on-boarding interviews to provide feedback regarding turnover and employee desires for growth and development. These interviews are also utilized to identify drivers of voluntary turnover and departures from the Company to alert us to any issues, as well as to make improvements to the employee experience. Employee turnover rate and reasons, including voluntary and involuntary departures, are monitored annually, and reviewed at regular intervals with the senior leadership team and Board of Directors. • We promote ongoing career development for employees to encourage innovation and engagement through constructive reviews and various talent/leadership development initiatives. • We are committed to maintaining a solid pipeline of talent and developing future leaders throughout our organization, including a New Business Leader program, Engineering Leadership Development Program, and Succession Planning Program. Over the past several years, we have also hosted “Careers in Engineering” near one of our facilities in the United Kingdom to promote engineering careers for adolescents, and consistently engage with local colleges and universities across our many facilities globally. • We cultivate technical, domain expertise and collaborative thought leadership for early through advanced career levels through our Technical Fellows program and our Innovation program. These important programs foster our culture of innovation, fuel collaboration across diverse disciplines, and help us attract, mentor, and inspire the next generation of talent. • We are committed to a global workforce that represents and reflects the communities where we operate. Our Affirmative Action Plans drive our compliance in the U.S., and we use similar programs globally that encourage diversity, equity, and inclusion. In addition, we provide annual training to our global workforce on respect for the individual. • We offer a tuition reimbursement program for those employees seeking to improve or complete their education consistent with their career paths. • We are committed to providing a safe and healthy work environment for our global employee base, guided by a strong set of core values and annual training policies outlined in our EHS Policy. We promote employee wellness. • We provide our employees and their families with a variety of health and wellness programs such as free annual biometric screening and health assessments at work or offsite, annual free flu shot clinics, a tobacco cessation program, weight management programs and an employee assistance program, which offers advice on mental health, legal and financial issues. |

| 6 |

| Business Practice | We secure critical data that drives the development of customer solutions and protect the privacy of our employees. • We comply with all applicable privacy and cybersecurity laws and regulation. • Our cybersecurity and data protection program includes the deployment of tools and activities designed to prevent, detect, and analyze current and emerging cybersecurity threats, and plans and strategies to address threats and incidents, including any associated with our use of third-party service providers. • We continually assess industry best practices, frameworks and standards and leverage them to advance our cybersecurity and data protection program’s maturity. • We employ periodic employee simulated phishing campaigns and perform regular internal/external security audits, vulnerability assessments, and penetration testing of our systems, products and practices affecting user data. • We conduct annual training programs on data privacy, cybersecurity, and insider threats for all employees and require annual certification that each employee has read our privacy policy. • Our incident response plan and cybersecurity landscape are tested annually by an external provider. | |

| Community Involvement | We promote the well-being of the communities in which the Company’s employees work and live. • We encourage employee involvement through charitable donations and volunteer programs. • We support investment in education by maintaining a Company-sponsored scholarship program for the dependent children of our employees where we fund 90 scholarships awarded to eligible individuals as selected by a third-party provider. Direct reports to the CEO are excluded from this program. | |

| Governance | We maintain the highest ethical standards in interactions with employees, customers, suppliers, competitors, and the general public. • Our Code of Conduct includes several important provisions on human rights, including prohibitions on human trafficking and the use of child labor or forced, bonded or indentured labor in our operations, as well as compliance with all applicable laws, including environmental. • We are committed to responsible sourcing of materials for our products by not directly purchasing conflict minerals (tin, tantalum, tungsten, and gold) from the Democratic Republic of Congo and adjoining countries, which are at risk of being mined and sold under the control of armed groups to finance conflict, and not having direct relationships with mines or smelters that process these minerals. Our Conflict Minerals Policy Statement requires our suppliers to support us in monitoring the sourcing of conflict minerals. • We maintain a strict supplier code of conduct that sets expectations about supplier behavior. • We are a multi-national organization, and as such, compliance with business ethics, anti-bribery, and trade compliance laws is a key component of our ethics commitment to conduct business lawfully and ethically. Accordingly, we maintain policies and conduct annual global workforce training programs requiring employee certification on ethics and anti-bribery/trade compliance including the Foreign Corrupt Practices Act (FCPA) and UK Bribery Act, along with other critical risk areas, and we offer a global, multi-lingual, 24/7 anonymous ethics hotline provided by a third-party provider so employees can report ethical concerns or suspected misconduct without fear of retaliation. • We conduct EH&S and financial audits of our facilities worldwide to ensure compliance with all applicable laws, regulations, policies, and procedures. • We maintain an Integrated Risk and Compliance program aligned with industry standards and regulatory requirements to support business objectives that integrates uniform risk management principles which are designed to identify, assess, prioritize, address, manage, monitor, and communicate risks across our operations to foster a culture of integrity and risk awareness. |

| 7 |

In support of the CSR, the Company maintains the following policies aimed at protecting the environment, health and safety, ethics and compliance with laws, respect for human rights, and supply chain management, all of which are available within the Governance section of the Company’s website at https://curtisswright.com/investor-relations/governance/governance-documents or by sending a request in writing to the Corporate Secretary, Curtiss-Wright Corporation, 130 Harbour Place Drive, Suite 300, Davidson, North Carolina 28036:

| • | California Transparency in Supply Chains Act of 2010 | |

| • | Code of Conduct | |

| • | Code of Conduct - Suppliers and Customers | |

| • | Conflict Minerals Policy Statement | |

| • | Corporate Social Responsibility | |

| • | Curtiss-Wright Corporation Standards for Suppliers: Environmental, Health and Safety, and Labor and Human Resources | |

| • | Environmental, Health and Safety Values | |

| • | Human Trafficking and Slavery | |

| • | Anti-Slavery and Human Trafficking Statement 2020 |

By adhering to the principles contained in the CSR program, the Company enriches the economic, social, and environmental aspects of the communities in which the Company’s employees live and work, which enhances the profitability of the Company and benefits the Company’s stockholders, employees, and customers.

| 8 |

CURTISS-WRIGHT CORPORATION

130 Harbour Place Drive, Suite 300, Davidson, North Carolina 28036

PROXY STATEMENT

PURPOSE

This Proxy Statement is being furnished in connection with the solicitation of proxies by the Board of Directors of Curtiss-Wright Corporation, a Delaware corporation (the “Company”), for use at the annual meeting of stockholders of the Company (the “Annual Meeting”) to be held on Thursday, May 10, 2018,2, 2024, at 10:1:00 a.m.p.m. local time, at the Homewood Suites by Hilton, 125 Harbour Place Drive, Davidson, North Carolina 28036, and at any adjournments or postponements thereof.

INTERNET AVAILABILITY OF PROXY MATERIALS

Pursuant to the rules adopted by the U.S. Securities and Exchange Commission (the “SEC”), the Company is furnishing proxy materials to its stockholders primarily via the internet, rather than mailing paper copies of these materials to each stockholder. On or about March 23, 2018,22, 2024, the Company will mail to each stockholder of record as of March 8, 2024 (other than those stockholders who previously had requested paper delivery of proxy materials) a Notice of Internet Availability of Proxy Materials containing instructions on how to access and review the proxy materials, including a Noticenotice and Proxy Statement and the Company’s combined Business Review/20172023 Annual Report on Form 10-K filed with the SEC. The Notice of Internet Availability of Proxy Materials also contains instructions on how to request a paper copy of the proxy materials. If you received a Notice of Internet Availability of Proxy Materials by mail, you will not receive a paper copy of the proxy materials unless you request one. If you would like to receive a paper copy of the proxy materials, please follow the instructions included in the Notice of Internet Availability of Proxy Materials. You can also choose to receive future proxy materials by email by following the instructions included in the Notice of Internet Availability of Proxy Materials. This will help the Company reduce the environmental impact and costs of printing and distributing paper copies and improve the speed and efficiency by which the Company’s stockholders can access these materials. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy-voting site. Your election to receive proxy materials by email will remain in effect until you revoke it. The Company may at its discretion voluntarily choose to mail or deliver a paper copy of the proxy materials, including a Notice and Proxy Statement and the combined Business Review/20172023 Annual Report on Form 10-K filed with the SEC, to one or more stockholders.

INFORMATION CONCERNING THE ANNUAL MEETING

Mailing and Solicitation.A Notice and Proxy Statement and combined Business Review/20172023 Annual Report on Form 10-K and accompanying form of proxy card attached hereto are being distributed or made available via the internet to the Company’s stockholders on or about March 23, 2018.22, 2024. For information about stockholders’ eligibility to vote at the Annual Meeting, please see “Record Date and Outstanding StockStock”” below. The Company will pay the cost of the solicitation of proxies. The solicitation is to be made primarily by mail but may be supplemented by telephone calls and personal solicitation by officers and other employees of the Company. The Company will reimburse banks and nominees for their expenses in forwarding proxy materials to the Company’s beneficial owners.

Proxies. Whether or not you plan to attend the Annual Meeting, the Company requests that you vote prior to the Annual Meeting: (i) via the internet, by following the instructions provided in the Notice of Internet Availability of Proxy Materials, (ii) via telephone, by following the instructions provided in the Notice of Internet Availability of Proxy Materials, or (iii) via mail, by completing, signing, dating and mailing a paper proxy card in a postage-paid return envelope, which a stockholder can request as outlined in the Notice of Internet Availability of Proxy Materials. A control number, contained in the

| 9 |

Notice of Internet Availability of Proxy Materials, is designed to verify your identity, and allow you to vote your shares, and confirm that your voting instructions have been properly recorded.

If your shares are registered directly in your name, you are the holder of record of these shares and the Company is sending a Notice of Internet Availability of Proxy Materials directly to you. As the holder of record, you have the right to vote by one of the three ways mentioned above or in person at the Annual Meeting. If your shares are held in “street name”, your bank, broker, or other nominee will send to you a Notice of Internet Availability of Proxy Materials. As a holder in street name, you have the right to direct your bank, broker, or other nominee how to vote by submitting voting instructions in the manner directed by your bank, broker, or other nominee. If you hold shares in street name and you wish to vote in person at the Annual Meeting, you must obtain a proxy issued in your name from your bank, broker, or other nominee and bring that proxy to the Annual Meeting.

Broker non-votes.Under the rules of the New York Stock Exchange (“NYSE”), a bank, broker, or other nominee who holds shares in “street name” for customers is precluded from exercising voting discretion with respect to the approval of non-routine matters (so called “broker non-votes”) in the absence of specific instructions from such customers. The (1) election of Directors (see Proposal One), (2) the approval to increase the total number of shares of the Company’s common stock reserved for issuance under the Curtiss-Wright Corporation Employee Stock Purchase2024 Omnibus Incentive Plan by 750,000 shares (see(See Proposal Three), and (3) the advisory (non-binding) vote to approve the compensation of the Company’s named executive officers (See Proposal Four), are considered “non-routine” matters under applicable NYSE rules. Therefore, a bank, broker, or other nominee is not entitled to vote the shares of Company common stock unless the beneficial owner has given instructions. As such, there may be broker non-votes with respect to these proposals. On the other hand, the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for 20182024 (see Proposal Two) is considered a “routine” matter under applicable NYSE rules. Therefore, a bank, broker, or other nominee will have discretionary authority to vote the shares of Company common stock if the beneficial owner has not given instructions and no broker non-votes will occur with respect to this proposal.

Voting In Accordance With Instructions. The shares represented by your properly submitted proxy received by mail, telephone, Internet, or in person will be voted in accordance with your instructions. If you are a registered holder and you do not specify in your properly submitted proxy how the shares represented thereby are to be voted, your shares will be voted:

(1) | “FOR” the election as Directors of the nominees proposed (see Proposal One), | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) | “FOR” the ratification of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (3) | “FOR” approval of the | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (4) | “FOR” the compensation of the Company’s named executive officers under the proposal regarding the advisory (non-binding) vote to approve the compensation of the Company’s named executive officers (see Proposal Four). | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

If your shares are held in street name and you do not specify how the shares represented thereby are to be voted, your bank, broker, or other nominee may exercise its discretionary authority to vote on Proposal Two only.

The Board of Directors is not aware of any other matters to be presented for action at the Annual Meeting, but if other matters are properly brought before the Annual Meeting, shares represented by properly completed proxies received by mail, telephone, internet, or in person will be voted in accordance with the judgment of the persons named as proxies.

Signatures in Certain Cases. If a stockholder is a corporation or unincorporated entity such as a partnership or limited liability company, the enclosed proxy should be signed in its corporate or other entity name by an authorized officer or person and his or her title should be indicated. If shares are registered in the name of two or more trustees or other persons, the proxy must be signed by a majority of them. If shares are registered in the name of a decedent, the proxy should be signed by the executor or administrator and his or her title should follow the signature.

| 10 |

2

Revocation of Proxies.Whether the proxy is submitted via the internet, telephone, or mail, stockholders have the right to revoke their proxies at any time before a vote is taken. If your shares are registered in your name, you may revoke your proxy (1) by notifying the Corporate Secretary of the Company in writing at the Company’s address given above, (2) by executing a new proxy bearing a later date or by submitting a new proxy by telephone or the internet on a later date, provided the new proxy is received by Broadridge Financial Solutions Inc. (which will have a representative present at the Annual Meeting) before the vote, (3) by attending the Annual Meeting and voting in person, or (4) by any other method available to stockholders by law. If your shares are held in street name, you should contact the record holder to obtain instructions if you wish to revoke your vote before the Annual Meeting.

Record Date and Outstanding StockStock.. The close of business on March 12, 20188, 2024 has been fixed as the record date of the Annual Meeting, and only stockholders of record at that time will be entitled to vote. The only capital stock of the Company issued and outstanding is the common stock, par value $1.00 per share (the “Common Stock”). As of March 12, 2018,8, 2024, there were 44,244,22238,280,037 shares of Common Stock issued and outstanding constituting all the capital stock of the Company entitled to vote at the Annual Meeting. Each stockholder is entitled to one vote for each share of Common Stock held.

Quorum. The presence, in person or by properly executed proxy, of the holders of a majority of the issued and outstanding shares of Common Stock entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting.

Required Vote.

Election of Directors: A plurality of the Common Stock present in person or represented by proxy (and eligible to vote), at a meeting in which a quorum is present. This means that a person will be elected who receives the first through ninth highest number of votes, even if he or she receives less than a majority of the votes cast. However, under our corporate governance guidelines, in an uncontested election where the only nominees are those recommended by the Board, any nominee for director who receives a greater number of votes “withheld” from his or her election than votes “for” his or her election is required to tender his or her resignation following certification of the stockholder vote. The Committee on Directors and Governance is required to make recommendations to the Board with respect to any such letter of resignation. The Board is required to take action with respect to this recommendation and to disclose their decision-making process. Full details of this policy are set out under “Proposal One: Election of Directors” on page 413 of this Proxy Statement.

Ratification of Deloitte & Touche LLP: The affirmative vote of a majority of the shares of Common Stock present in person or represented by proxy (and eligible to vote), at a meeting in which a quorum is present. This means that of the shares represented at the Annual Meeting and entitled to vote, a majority of them must be voted “for” this proposal for it to be approved.

Approval of the amendments to the Curtiss-Wright Corporation Employee Stock Purchase2024 Omnibus Incentive Plan as amended, including to increase the total number of shares of the Company’s common stock reserved for issuance under the plan by 750,000 shares: The affirmative vote of a majority of the shares of Common Stock present in person or represented by proxy (and eligible to vote), at a meeting in which a quorum is present. This means that of the shares represented at the Annual Meeting and entitled to vote, a majority of them must be voted “for” this proposal for it to be approved.

Advisory (non-binding vote) to approve the compensation of the Company’s named executive officers: The affirmative vote of a majority of the shares of Common Stock present in person or represented by proxy (and eligible to vote), at a meeting in which a quorum is present. This means that of the shares represented at the Annual Meeting and entitled to vote, a majority of them must be voted “for” this proposal for it to be approved.

Calculating Votes.Effect of Withhold Authority Votes, Abstentions and Broker Non-Votes.

Under the Delaware General Corporation Law (under which Curtiss-Wright Corporation is incorporated), an abstaining vote and a broker non-vote are counted as present and eligible to vote at the Annual Meeting and are, therefore, included for purposes of determining whether a quorum is present at the Annual Meeting.

| 11 |

With respect to election of directors (see Proposal One), if you “withhold” authority to vote with respect to one or more director nominees, your voteshares will not be voted and will have no effect on the election of such nominees.nominees because, under plurality voting rules, the nine director nominees receiving the highest number of “for” votes will be elected. A “withhold” vote is not considered a vote cast in director elections. Broker non-votes will have no effect on the election of the nominees.

With respect to the ratification of Deloitte & Touche LLP (see Proposal Two), if you “abstain”from voting with respect to this Proposal, your vote will have the same effect as a vote “against” the Proposal.Proposal. A bank, broker, or other nominee may exercise discretion to vote shares as to which instructions are not given on this Proposal and accordingly, no “broker non-votes” will occur with respect to this Proposal.

3

With respect to (i) the approval to increase the total number of shares of the Company’s common stock reserved for issuance under the Curtiss-Wright Corporation Employee Stock Purchase2024 Omnibus Incentive Plan by 750,000 shares (see Proposal Three) and (ii), if you “abstain” from voting with respect to this Proposal, your vote will have the same effect as a vote “against” such Proposal. Broker non-votes will not be counted as having voted either for or against this Proposal.

With respect to the advisory vote to approve executive compensation (see Proposal Four), if you “abstain”from voting with respect to these Proposals,this Proposal, your vote will have the same effect as a vote “against” such Proposals.Proposal. Broker non-votes will not be counted as having voted either for or against any of these Proposals.this Proposal.

Dissenter’s Rights of AppraisalAppraisal.. The stockholders have no dissenter’s rights of appraisal under the Delaware General Corporation Law, the Company’s Restated Certificate of Incorporation, or the Company’s Amended and Restated By-Laws with respect to the matters to be voted on at the Annual Meeting.

PROPOSAL ONE:ELECTION OF DIRECTORS

General Information

At the date of this Proxy Statement, the Board of Directors of the Company (the “Board” or “Board of Directors”) consists of 10ten members, nine of whom are non-employee Directors.

After extensive discussion, However, S. Marce Fuller, who is presently a Director of the Company, has advised the Board voted on February 7, 2018of her decision to retain Dr. Allen A. Kozinskiretire from the Board with more than 24 years of distinguished service and leadership at Curtiss-Wright, which includes serving as a directorLead Independent Director for an additional one-year term. The Board voted on February 7, 2017 to retain Dr. Kozinski as a director for only one year beyond reaching his 75th birthday but now believes that this action is in the best interest of the Company. This action retains continuity in Board experience so that the Board’s operations would not be adversely affected in having to replace Dr. Kozinski following the departure of three other Board members over the past twothree years. It also allowsMs. Fuller’s term will expire just prior to the three newAnnual Meeting. Ms. Fuller served on the Board members elected within the past two years the benefit of working with Dr. Kozinski for an additional transitional year to learn more about Board practices and culture.great distinction.

The Committee on Directors and Governance of the Board of Directors has recommended, and our full Board of Directors has nominated David C. Adams,Lynn M. Bamford, Dean M. Flatt, S. Marce Fuller, Rita J. Heise, Bruce D. Hoechner, Dr. Allen A. Kozinski, John B. Nathman,Glenda J. Minor, Anthony J. Moraco, William F. Moran, Robert J. Rivet, Albert E. Smith, and Peter C. Wallace, and Larry D. Wyche, each currently serving Directors, to be elected to the Board for a one-year term. Each nominee indicated his or her willingness to serve. In the event that any nominee should become unavailable for election, the persons named in the proxy may vote for the election of a substitute nominee.

Directors will be elected by a plurality of votes properly cast (in person or by proxy) at the Annual Meeting. This means that a person will be elected who receives the first through tenthninth highest number of votes, even if he or she receives less than a majority of the votes cast. Therefore, stockholders who do not vote or withhold their vote from one or more of the proposed nominees and do not vote for another person, will not affect the outcome of the election provided that a quorum is present at the Annual Meeting. However, under our corporate governance guidelines, in an uncontested election of Directors where the only nominees are those recommended by the Board (which is the case for the election of Directors at this Annual Meeting), any nominee for director who receives a greater number of votes “withheld” from his or her election than votes “for” his or her election (a “Majority Withheld Vote”) is required to tender his or her resignation following certification of the stockholder vote. The Committee on Directors and Governance must promptly consider the resignation offer and a range of possible responses based on the circumstances that led to the Majority Withheld Vote, if known, and make a recommendation to the Board. The Board will act on the Committee on Directors and Governance recommendation within 90 days following certification of the stockholder vote. Thereafter,

| 12 |

the Board will promptly disclose its decision-making process and decision regarding whether to accept the Director’s resignation (or the reason(s) for rejecting the resignation offer, if applicable) in a Form 8-K filed with the SEC. Any Director who tenders his or her resignation pursuant to this provision will not participate in the Committee on Directors and Governance recommendation or the Board action regarding whether to accept or reject the resignation offer.

As further discussed in the section titled “Broker non-votesnon-votes”” on page 210 of this Proxy Statement, if you own shares of Common Stock through a bank, broker or other holder of record, you must instruct

4

your bank, broker, or other holder of record how to vote in order for them to vote your shares of Common Stock so that your vote can be counted on this Proposal One.

Overview of Curtiss-Wright’s Current Board of Directors

The Board believes there are general requirements for service as a member of the Board that are applicable to all directors as laid out below, and other specialized characteristics that should be represented on the Board as a whole but not necessarily by each director. The specific qualifications, skills, experiences, and backgrounds of our director nominees are detailed in the section titled “Director Qualifications, Experiences, Backgrounds, and Diversity” on page 13 of this Proxy Statement.

Our Directors Exhibit: High integrity Loyalty to the Company and commitment to its success Proven record of success Knowledge of corporate governance and practices Our Directors Bring to the Boardroom: High level of leadership experience Specialized industry experience Financial expertise Extensive knowledge of the Company | Board Composition: Independent Directors: 9 of 10 Average Company Board Tenure: 6 years Average Age: 66 years Diversity of gender, race, ethnicity, or sexual orientation: 3 Female |

Director Qualifications, Experiences, Backgrounds, and Diversity

The Company’s director nominees have substantial leadership, management, and industry experience and expertise in various fields. Three of the Company’s nine director nominees self-identify as having diverse characteristics (race, gender, ethnicity or sexual orientation). This diversity of experience and background of our director nominees, illustrated in the skills matrix and director nominees’ biographies that follow, is brought to bear in Board deliberations, during which multiple perspectives are considered in developing dynamic solutions to achieve the Company’s strategic priorities to reduce complexity, drive returns, and advance sustainably.

The skills matrix below summarizes the specific qualifications, skills, experiences, and backgrounds of each director nominee. While each director nominee is generally knowledgeable in each of these areas, an “X” in the skills matrix below indicates that the item is a specific qualification, skill, experience or attribute that the director nominee brings to the Board. The lack of an “X” for a particular item does not mean that the director nominee does not possess that qualification, skill,

| 13 |

experience or attribute. Because the skills matrix is only a summary, it does not include all the qualifications, skills, experiences, backgrounds, and diversity that each director nominee offers.

| Qualifications/Experiences/Backgrounds/Diversity | ||||||||

| Director | Audit Committee Financial Expert | Extensive Knowledge of Company’s Business and Industry | Extensive M&A Experience | Broad International Experience | Other Public Company Board Experience | Current or Former CEO | Senior Leadership Experience | Gender/Ethnic/ Race/Sexual Orientation Diversity (a) |

| Lynn M. Bamford | X | X | X | X | ||||

| Dean M. Flatt | X | X | X | X | ||||

| Bruce D. Hoechner | X | X | X | X | X | X | ||

| Glenda J. Minor | X | X | X | X | X | X | X | |

| Anthony J. Moraco | X | X | X | X | X | |||

| William F. Moran | X | X | X | |||||

| Robert J. Rivet | X | X | X | X | X | X | ||

| Peter C. Wallace | X | X | X | X | X | X | ||

| Larry D. Wyche | X | X | X | X | ||||

| (a) | Self-identifies as having diverse characteristics (race, gender, ethnicity, or sexual orientation). |

In addition to gender, ethnic, race, and sexual orientation diversity, the Company also recognizes the value of other diverse attributes that directors may bring to the Board, including veterans of the U.S. military. The Company is proud to report that of our nine director nominees, three are also military veterans with over 77 years of combined service.

| 14 |

Information Regarding Nominees

Set forth below is information with respect to the nominees for Directors. Such information includes the principal occupation of each nominee for Director during, at least, the past five years, as well as a brief description of the particular experience, qualifications, attributes or skills that qualify the nominee to serve as a Director of the Company.

David C. Adams, age 64, has served as Chairman and Chief Executive Officer of the Company since January 1, 2015. Prior to this, he served as President and Chief Executive Officer of the Company from August 2013. He served as President and Chief Operating Officer of the Company from October 2012; Co-Chief Operating Officer from November 2008; President of Curtiss-Wright Controls from June 2005; and Vice President of the Company from November 2005. He has served as a Director of the Company since August 2013. Mr. Adams also serves as a director of Snap-On Incorporated.

Mr. Adams has been an employee of the Company for more than 17 years, serving in increasing levels of strategic, operational, and managerial responsibility, as discussed above. Mr. Adams’ ability to grow the Company and in-depth knowledge of the Company’s business segments and industries in which they operate, as evidenced by the Company’s strong growth during his tenure as Chief Executive Officer provides the Company a competitive advantage in continuing to improve long-term performance and increase stockholder value.

Dean M. Flatt, age 67, served as President and Chief Operating Officer of Honeywell International Inc.’s Defense and Space business from July 2005 to July 2008. Prior to that, he served as President of Honeywell International Inc.’s Aerospace Electronics Systems business from December 2001 to July 2005 and served as President of Honeywell International Inc.’s Specialty Materials and Chemicals business from July 2000 to December 2001. Further, he serves as a director of Ducommun Incorporated and Industrial Container Services, Inc. (also serving as Chairperson of the Compensation Committee) since January 2009 and January 2012, respectively, and serves as non-executive Chairman of National Technical Systems, Inc. since January 2014. He has served as Director of the Company since February 2012 and serves as a member of the Audit Committee and the Executive Compensation Committee.

Mr. Flatt has an in-depth understanding of the aerospace industry, evidenced by his past employment in high-level managerial positions at Honeywell International Inc., a leading global supplier of aerospace products, one of the Company’s major markets. In addition, Mr. Flatt has extensive experience in evaluating new business opportunities gained while serving on the executive board of a private equity firm. Furthermore, Mr. Flatt has extensive managerial experience in operating a business at the director level, serving as a current director of Ducommun Incorporated, Industrial Container Services, Inc., and National Technical Systems, Inc. Mr. Flatt’s ability to lead a company at one of the highest levels of management, coupled with his in-depth knowledge of the aerospace industry and private equity investing provides the Company with a competitive advantage in seeking new opportunities and platforms for its aerospace industry products and services, as well as strengthening the ability of the Company to select strategic acquisitions.

S. Marce Fuller, age 57, was the President and Chief Executive Officer of Mirant Corporation from July 1999 to October 2005, and a Director of Mirant Corporation from July 1999 until January 2006. She served as a Director of Earthlink, Inc., an IT services, network, and communication provider, from January 2002 to April 2014. At Earthlink, she served as Chairperson of the Audit Committee, Leadership and Compensation Committee, and Corporate Governance and Nominating Committee, and as Lead Independent Director. She has served as a Director of the Company since 2000 and serves as Chairperson of the Executive Compensation Committee and as a member of the Audit Committee. She also served as Lead Independent Director of the Company from May 2015 to May 2016.

5

Ms. Fuller has an in-depth understanding of the power generation industry, evidenced by her past employment at Southern Energy and Mirant Corporation, both leading power generation companies. At these companies, Ms. Fuller served at times in increasing levels of managerial responsibility, beginning with Vice President at Southern Energy and then as President and Chief Executive Officer of both Southern Energy and Mirant Corporation. Ms. Fuller’s ability to lead a company at the highest level of management, coupled with her in-depth knowledge of the power generation industry, one of the Company’s largest markets, provides the Company a competitive advantage in seeking new opportunities and platforms for its power generation industry products and services.

Rita J. Heise,age 61, has worked as a business consultant since January 2012. From 2002 through her retirement in December 2011, she served as a corporate vice president and chief information officer of Cargill, Incorporated, an international producer and marketer of food, agricultural, financial, and industrial products and services and one of the largest privately owned companies in the world. Prior to joining Cargill, Ms. Heise was the chief information officer for the aerospace business of Honeywell International Inc. and for Honeywell’s Europe, Middle East, and Africa operations. Since 2012, Ms. Heise has been a Director of Fastenal Company and is a member of the Compensation Committee. Ms. Heise has participated in information technology industry committees and currently serves as chair of the board of Blue Cross Blue Shield of Minnesota, a non-profit health services company. She previously served on the board of Adventium Labs, a privately held systems engineering and cyber-security company. She has served as a Director of the Company since 2016 and serves as a member of the Audit Committee and the Committee on Directors and Governance.

Ms. Heise’s information technology background, combined with a diverse operations background, offers the board valuable insight on ways for the Company to maximize the use of advancing technologies in marketing, operations, and distribution.

Bruce D. Hoechner, age 58, has served as President and Chief Executive Officer and as a member of the Board of Directors of Rogers Corporation, a NYSE-listed company, since October 2011. Rogers Corporation is a leading provider of engineered materials and components for mission critical applications serving the telecommunications, electronics, transportation, automotive, consumer, and defense markets. From October 2009 to October 2011, Mr. Hochner served as President, Asia Pacific region, based in Shanghai, China, for Dow Chemical Company, a global diversified chemical and material company. Prior to its acquisition by Dow Chemical Company, Mr. Hoechner held positions of increasing responsibility in the U.S. and internationally with Rohm and Haas Company, a leading manufacturer of specialty chemicals. He has served as a Director of the Company since 2017 and serves as a member of the Committee on Directors and Governance and the Finance Committee.

Mr. Hoechner has many years of broad leadership experience across numerous geographies, businesses, and functions with particularly strong international experience. Mr. Hoechner brings to the Board the perspective of someone familiar with all facets of worldwide business operations, with significant expertise in international marketing and business strategy development as well as the experience of leading a global, NYSE-listed company. This broad and extensive experience in leadership roles, along with his board experience, enhances Mr. Hoechner’s contributions and values to the Company’s Board.

Dr. Allen A. Kozinski, age 76, served as Group Vice President, Global Refining of BP PLC from 1998 through 2002. He has served as a Director of the Company since 2007 and serves as Chairperson of the Committee on Directors and Governance and as a member of the Finance Committee.Since May 2017, he is also serving as Lead Independent Director of the Company for a term of one year expiring in May 2018, or until his successor is appointed.

Dr. Kozinski has an in-depth understanding of the oil and gas industry, evidenced by his past employment at Amoco Corporation and BP, both leading oil and gas companies. At these companies, Dr. Kozinski served at times in increasing levels of managerial responsibility, beginning with business unit manager and then Vice President, Technology, Engineering and International Development at Amoco, and Group Vice President, Global Refining at BP. Dr. Kozinski’s ability to lead a company’s business segment at a high level of management, coupled with his in-depth knowledge of the oil and gas industry, one of the Company’s end markets, provides the Company a competitive advantage in seeking new opportunities and platforms for its industrial products and services.

6

Admiral (Ret.) John B. Nathman, age 69, served as commander of U.S. Fleet Forces Command from February 2005 to May 2007. From August 2004 to February 2005, he served as Vice Chief of Naval Operations in the U.S. Navy. From August 2002 to August 2004, he served as Deputy Chief of Naval Operations for Warfare Requirements and Programs at the Pentagon. From October 2001 to August 2002, he served as Commander, Naval Air Forces. From August 2000 to October 2001, he served as Commander of Naval Air Forces, U.S. Pacific Fleet. He has served as a Director of the Company since 2008 and serves as a member of the Audit Committee and the Committee on Directors and Governance.

Admiral Nathman’s strong leadership, coupled with an in-depth understanding of U.S. government spending, especially defense spending and military products, evidenced by 37 years of service in high-level commands in the United States Navy, provides the Company a competitive advantage in seeking new opportunities and platforms for its defense industry products and services.

Robert J. Rivet, age 64, was Executive Vice President, Chief Operations and Administrative Officer of Advanced Micro Devices, Inc., a leading global semiconductor company, from October 2008 to February 2011, and was Executive Vice President, Chief Financial Officer of Advanced Micro Devices, Inc. from September 2000 until October 2009. From 2009 to 2011, he also served as a Director of Globalfoundries Inc., a semiconductor foundry. He has served as a Director of the Company since 2011 and serves as Chairperson of the Audit Committee and as a member of the Executive Compensation Committee.

Mr. Rivet has an in-depth understanding of the preparation and analysis of financial statements based upon his 35 years of financial experience, including nine years as Chief Financial Officer of Advanced Micro Devices. In addition, Mr. Rivet led numerous acquisition and divestiture activities while at Advanced Micro Devices. Mr. Rivet’s extensive financial knowledge will be an invaluable asset to the Board in its oversight of the integrity of the Company’s financial statements and the financial reporting process. Additionally, his in-depth understanding of high-technology industries such as the semiconductor business, and experience in mergers and acquisitions provides the Company a competitive advantage in seeking new strategic business opportunities and acquisitions.

Albert E. Smith, age 68, served as Chairman of Tetra Tech, Inc., a leading provider of consulting and engineering services, from March 2006 to January 2008 and has been a director of Tetra Tech since May 2005. He was a director of CDI Corp., a former provider of engineering and information technology solutions, from October 2008 to September 2017. From 2002 to 2005, he served as a member of the Secretary of Defense’s Science Board. Mr. Smith was employed at Lockheed Martin Corp. from August 1985 to January 2005. Mr. Smith served as an Executive Vice President of Lockheed Martin from September 1999 until June 2005. He has served as a Director of the Company since 2006 and serves as Chairperson of the Finance Committee and as a member of the Committee on Directors and Governance. He also served as Lead Independent Director of the Company from May 2016 to May 2017.

Mr. Smith has an in-depth understanding of the aerospace industry, evidenced by his past employment at Lockheed Martin, a leading aerospace company. At Lockheed, Mr. Smith served in high-level managerial positions. In addition, Mr. Smith has extensive managerial experience in operating a business at the director level, serving as a current director of Tetra Tech, a public company, and past service as a director of CDI Corp., a former public company. Mr. Smith’s experience as a director (both past and present) at other public companies and ability to lead a company at one of the highest levels of management, coupled with his in-depth knowledge of the aerospace industry, one of the Company’s largest markets, provides the Company a competitive advantage in seeking new opportunities and platforms for its aerospace industry products and services.

Peter C. Wallace, age 63, served as Chief Executive Officer and a Director of Gardner Denver Inc. from June 2014 until his retirement as of January 1, 2016. Gardner Denver is an industrial manufacturer of compressors, blowers, pumps, and other fluid control products used in numerous global end markets. Prior to joining Gardner Denver, Mr. Wallace was President and Chief Executive Officer, and a Director, of Robbins & Myers, Inc., from 2004 until it was acquired in February 2013 by National Oilwell Varco, Inc. Robbins & Myers was a leading designer, manufacturer, and marketer of highly engineered, application-critical equipment and systems for energy, chemical, pharmaceutical,

7

and industrial markets worldwide. Mr. Wallace is also a Director of Applied Industrial Technologies, Inc., a leading provider of industrial products and fluid power components, and Rogers Corporation, a leading provider of engineered materials and components for mission critical applications across various markets. Mr. Wallace also serves on the board of a private manufacturing firm engaged in packaging equipment and industrial markets. He has served as a Director of the Company since 2016 and serves as a member of the Executive Compensation Committee and the Finance Committee.

Mr. Wallace has a wide and varied background as a senior executive in global industrial equipment manufacturing, one of the Company’s end markets. Mr. Wallace brings to the Board the perspective of someone familiar with all facets of worldwide business operations, including the experience of leading a NYSE-listed company. This broad and extensive experience in leadership roles, along with his board experience, enhances Mr. Wallace’s contributions and values to the Company’s Board.

Directorships at Public Companies

The following table sets forth any directorships at other public companies and registered investment companies held by each nominee for Director at any time during the past five years.

| Lynn M. Bamford Chair and Chief Executive Officer Curtiss-Wright Corporation Age: 60 Director Since: 2021 Other Public Company Directorships: None Career Highlights: Ms. Bamford has served as Chair of the Board of Directors of the Company since May 2022 and Chief Executive Officer of the Company since January 1, 2021. She has served as a member of the Board of Directors of the Company since January 1, 2021. She also formerly held the title of President of the Company from January 1, 2021 to May 5, 2022. Prior to this, she served as President and Chief Executive Officer of the Company from January 2021. She also served as President of the Company’s Defense and Power Segments from January 2020 and served as Senior Vice President and General Manager of the Company’s Defense Solutions and Nuclear divisions from 2018, and Senior Vice President and General Manager of the Company’s Defense Solutions division from 2013. Shortly after joining the Company in 2004, she assumed the position of Vice President, Product Development and Marketing, for the Company’s former Controls segment, and ascended to Vice President and General Manager of the Company’s Embedded Computing business. Reasons for Election to the Board of Curtiss-Wright: Ms. Bamford has been an employee of the Company for more than 18 years, serving in increasing levels of strategic, operational, and managerial responsibility. Ms. Bamford’s ability to grow the Company’s Defense and Power segments, as evidenced by the Company’s Defense and Power segments strong growth during her leadership, and in-depth knowledge of all the Company’s business segments and industries in which they operate, provides the Company a competitive advantage in continuing to improve long-term performance and increase stockholder value. |

|

|

| |

Dean M. Flatt Retired President and Chief Operating Officer Honeywell International Inc., Defense and Space Business Age: 73 Director Since: 2012 Committees: Finance (Chair); Executive Compensation Other Public Company Directorships: Ducommun Incorporated (2009 – present) Career Highlights: Mr. Flatt served as President and Chief Operating Officer of Honeywell International Inc.’s Defense and Space business from July 2005 to July 2008. Prior to that, he served as President of Honeywell International Inc.’s Aerospace Electronics Systems business from December 2001 to July 2005 and served as President of Honeywell International Inc.’s Specialty Materials and Chemicals business from July 2000 to December 2001. Further, he serves as a director of Ducommun Incorporated since January 2009 where he currently serves as Chairman of the Compensation Committee and as Lead Director. Ducommun is a leading provider of engineered products and aftermarket services across various industries, including aerospace and defense. He formerly served as a director of National Technical Systems, Inc. from January 2014 until September 2022 (he formerly served as non-executive Chairman from January 2014 until January 2018). National Technical Systems is a leading provider of engineering and testing services across various industries, including aerospace and defense. He formerly served as a director of Industrial Container Services, Inc. from January 2012 until April 2017. Reasons for Election to the Board of Curtiss-Wright: Mr. Flatt has an in-depth understanding of the aerospace and defense industries, evidenced by his past employment in high-level managerial positions at Honeywell International Inc., a leading global supplier of aerospace and defense products, two of the Company’s major markets. In addition, Mr. Flatt has extensive experience in evaluating new business opportunities gained while serving on the executive board of a private equity firm. Furthermore, Mr. Flatt has extensive managerial experience in operating a business at the director level, serving as a current director of Ducommun Incorporated and a previous director of National Technical Systems, Inc. Mr. Flatt’s ability to lead a company at one of the highest levels of management, coupled with his in-depth knowledge of the aerospace and defense industries and private equity investing provides the Company with a competitive advantage in seeking new opportunities and platforms for its aerospace and defense industry products and services, as well as strengthening the ability of the Company to select strategic acquisitions. |

| 16 |

|

Retired President and Chief Executive Officer Rogers Corporation Age: 64 Director Since: 2017 Committees: Committee on Directors and Governance; Finance Other Public Company Directorships: Ingevity Corporation (2023 – present) Rogers Corporation (2011 – 2023) Career Highlights: Mr. Hoechner served as President and Chief Executive Officer of Rogers Corporation, a NYSE-listed company from October 2011 until his retirement on December 31, 2022. He also served as a member of the Board of Directors of Rogers Corporation until retirement from such Board on March 31, 2023. Rogers Corporation is a leading global provider of engineered materials and components for mission critical applications serving telecommunications, automotive, defense and aerospace, and consumer markets. Mr. Hoechner also serves as a director of Ingevity Corporation since February 2023. Ingevity is a leading manufacturer of specialty chemicals. From October 2009 to October 2011, Mr. Hoechner served as President, Asia Pacific region, based in Shanghai, China, for Dow Chemical Company, a global diversified chemical and material company, and before that held positions of increasing responsibility in the U.S. and internationally during his 27-year career with Rohm and Haas Company, a leading manufacturer of specialty chemicals, which was purchased by Dow. Reasons for Election to the Board of Curtiss-Wright: Mr. Hoechner has many years of broad leadership experience across numerous geographies, businesses, and functions with particularly strong international experience at leading multinational organizations. In his prior capacity as CEO and President of Rogers Corporation, Mr. Hoechner led a business transformation that significantly improved revenues and profitability, and resulted in a substantial increase in the company’s market cap. Mr. Hoechner brings to our Board international executive experience in technology manufacturing, with relevant industry exposure, as well as extensive strategic and financial acumen, which enhances Mr. Hoechner’s contributions and value to the Company’s Board. |

|

|